Where should I buy it?

McDuffie Metal Associates

McDuffie Metal Associates

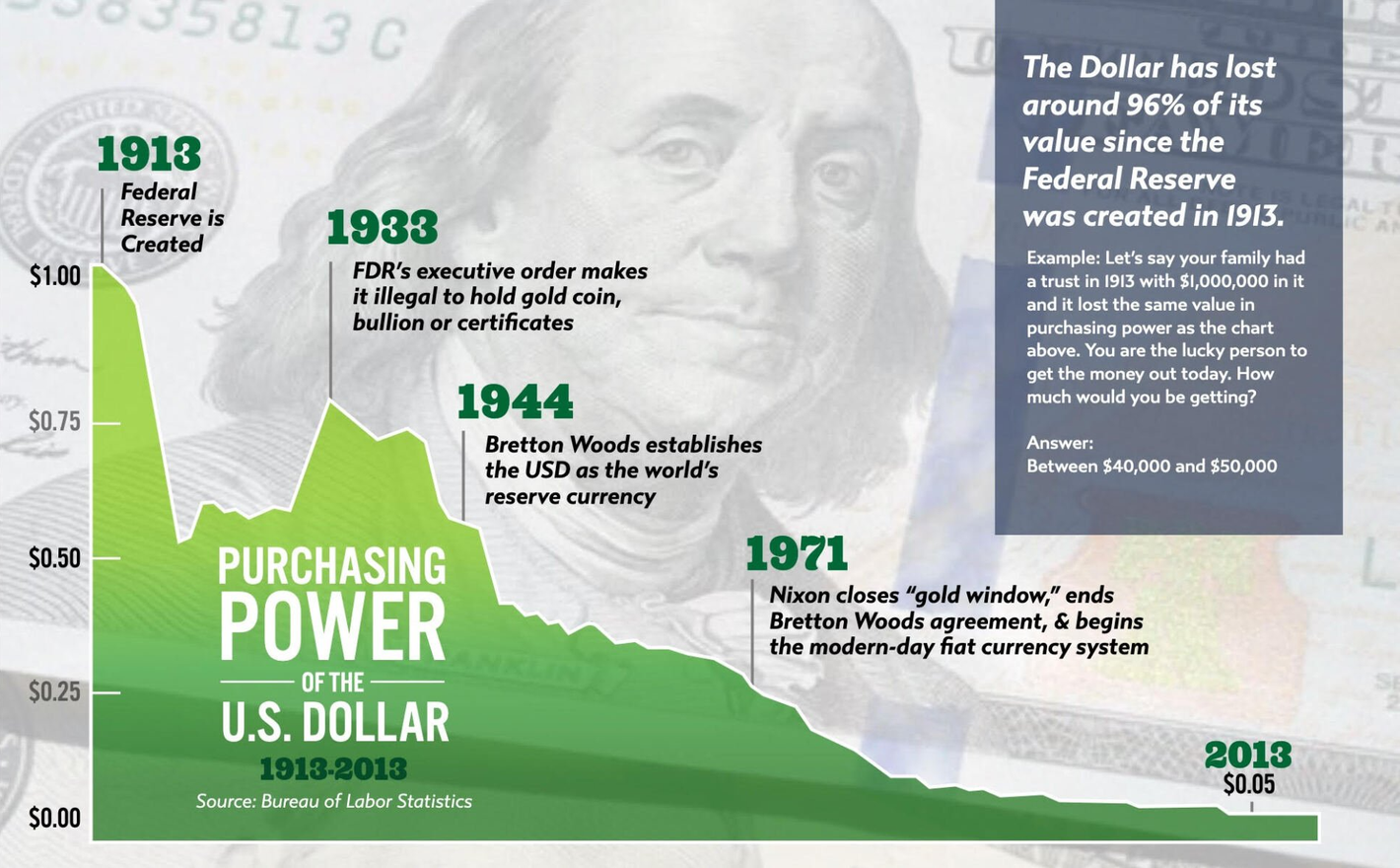

We’ve seen the writing on the wall with our current financial system, the rising national debt, and the continued decline of the US dollar. We were introduced to the realities of currency and real money and decided that we had to change the way we secured our investments outside of the traditional strategies. After doing our own research, we became active buyers of precious metals because we saw it as a way to better secure the future of our family’s current assets and build our wealth.

It’s important to understand that when you purchase silver, gold or other precious metals, you’re trading the declining U.S. dollars in your pocket, currency, for real money that has the potential for a much larger upside. But unlike the currency which has no more value than the paper it is printed on, precious metals have intrinsic value, have consistently retained their value and have been a store of wealth for centuries. While YOU must make the best decision for your own finances, we strongly encourage taking advantage of market manipulation and artificially depressed costs and start buying these metals now.

We believe EVERYBODY deserves a chance at a life with prosperity. If you’ve ever wondered what it’s all about and how to get started we’d love to share some information and an opportunity with you. Take some time to learn how simple it is to help secure your future and let us help you get started.

You won't regret it.

So why should I buy precious metals?

Here is the harsh reality for most. Wages are increasing but not keeping up with the rate of inflation. Inflation continues at rates we haven’t seen in decades, and more than 63% of Americans are living paycheck to paycheck. According to MSN, personal savings balances are in a nosedive and credit card balances are up by 15%, the highest annual increase in over 20 years.

Fiat currencies like the US Dollar are volatile and precarious by nature. Volume of currency in circulation, consumer confidence levels and a whole lot of speculation are the primary drivers in the strength and valuation of the dollar. With zero tangible assets to back or supporting their valuation, central banks all too often print currency as needed to "stimulate the economy" with little restraint. In our case, these are the privately held Federal Reserve Banks - not government entities at all. When the currency supply is increased at a disproportionate rate to the availability of goods and services, inflation is the result.

By contrast, tangible precious metals you hold in your possession can't and won't just materialize out of thin air or a few keystrokes. They have no counterparty risk, can’t go bankrupt or go into default, and can’t be corrupted into making reckless financial decisions. Therefore, an excellent hedge against the loss of value is converting currency to precious metals.

Take a look at critical take-aways from some recent headlines:

-

Slide title

“O’Leary’s figures are not wrong. Federal Reserve data show that in August 2019 there was $14.9 trillion total in circulation. By January 2022, there was $21.6 trillion. In other words, more than 30 percent of dollars in circulation in January had been created in the previous 30 months.”

Button -

Slide title

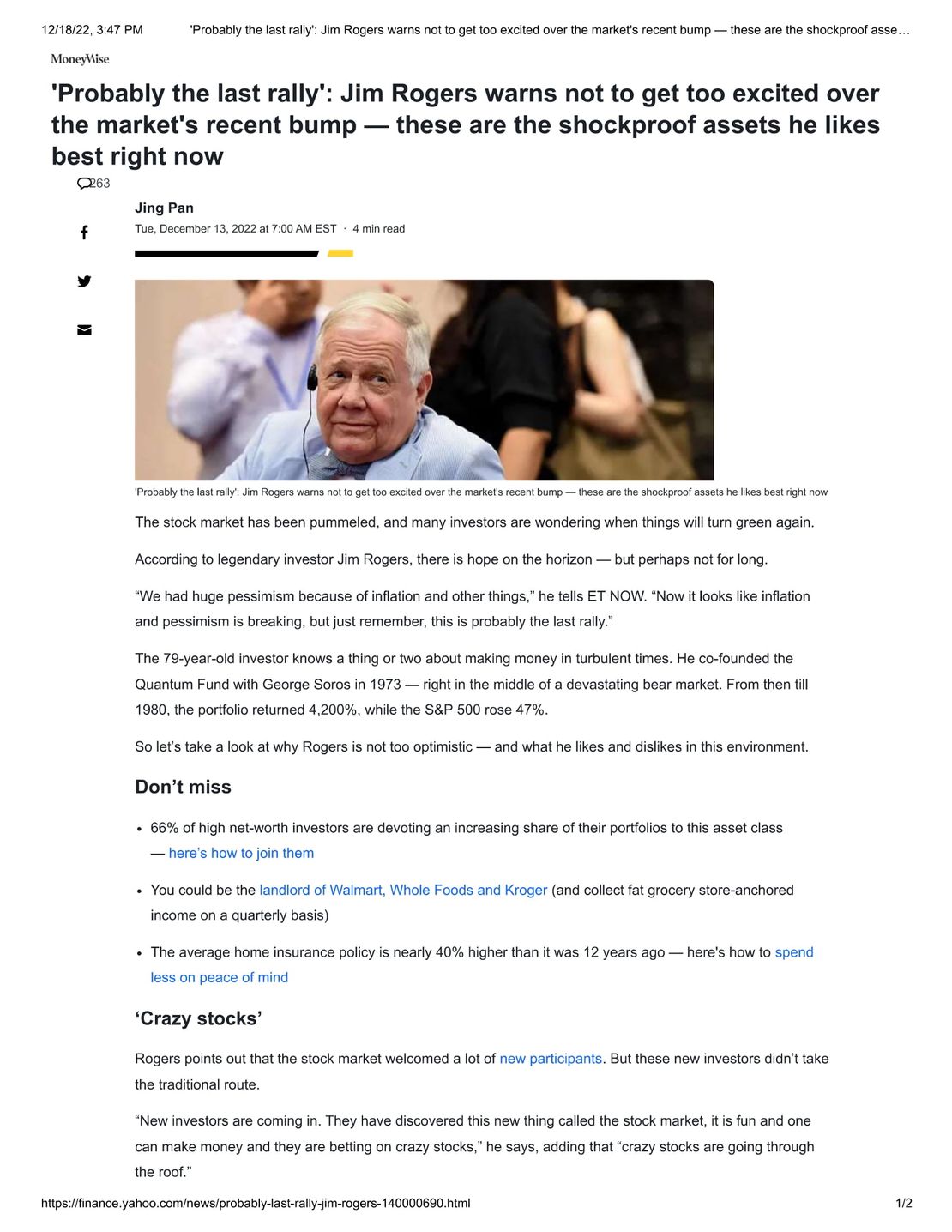

“I own commodities and commodities are going to do well because of supply constraints that are developing and the central banks will print more money eventually because that is all they know to do, he says. “When we have a recession, they will panic and print more money and when there is a lot of money printing, the main thing to own are real assets.”

Button -

Slide title

Sound money literally refers to real wealth, with a natural, unmistakable signature of authenticity, as opposed to the paper, plastic, and electronic debt instruments used almost exclusively today.

Button -

Slide title

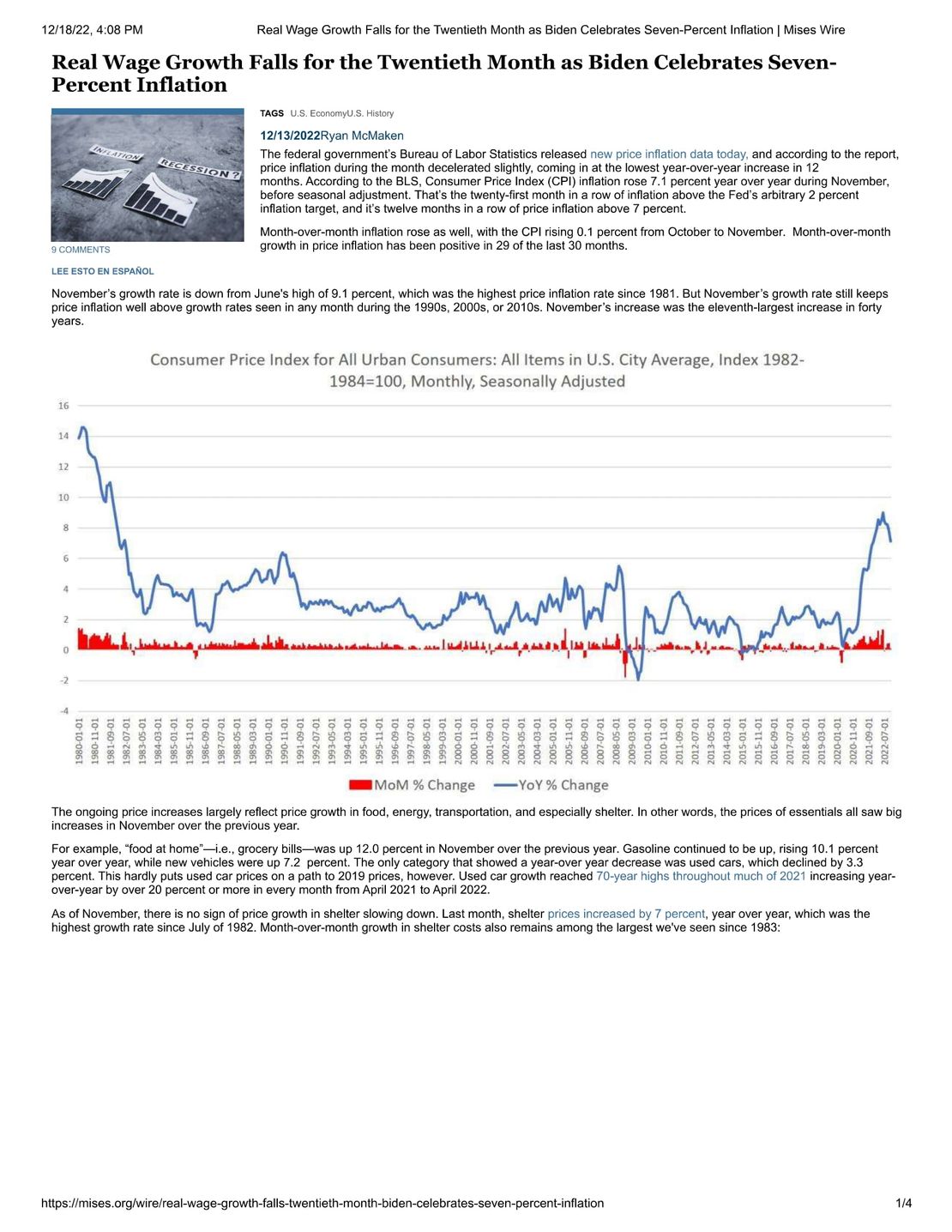

November was yet another month of declining real wages, and was the twentieth month in a row during which growth in average hourly earnings failed to keep up with CPI inflation. According to new employment data released last week by the BLS, hourly earnings had increased 5.09 percent in November year, over year, meaning wage growth fell behind inflation:

Button -

Slide title

He concluded by arguing that Americans “don’t want this” and are “sick and tired of it.” “They are paying for it through the nose with inflation,” he said. “Adding a trillion dollars to the deficit will simply fuel the fires that are consuming our wages and consuming our retirement plans.”

Button -

Slide title

Often considered the go-to inflation-fighting move precious metals can’t be printed out of thin air like fiat money, and their value is largely unaffected by economic events around the world. Because of the precious metal’s safe-haven status, investors often rush towards it in times of crisis, making it an effective hedge.

Button -

Slide title

Up from almost zero at the start of the year, the Fed’s main policy rate target currently sits between 4.25% and 4.5%, with the 2023 median rate projection of 5.1% and an expectation for the need to keep rates up for longer than anticipated.

Button

Gold and silver are a well kept secret that the wealthy have used to amass and protect their wealth for decades.

The unfortunate reality is that most of us have never been taught about real money. You’re probably like us - you’ve heard about it and seen it advertised all over but have some very good and legitimate questions such as:

Who should I trust?

What should I buy?

How do I buy in small quantities?

How do I get more for my money?

Wealth made simple.

McDuffie Metal Associates has partnered with a team of world-class experts to educate members and to deliver rare, high-quality, and/or unique precious metals at impressive and competitive prices. They also offer wealth building programs to suit every level of experience — and every budget.

Coins and collectables are delivered directly to your door, putting precious metals (tangible sound money) in your hands with zero hassles.

Let us show you the case for sound wealth building.

We want to help you get started on your adventure to creating and protecting true wealth for your family and are part of the Our Silverlines community of like-minded individuals

No one can spend their way out of debt. McDuffie Metal Associates can however, provide you with a vehicle to help teach you about precious metals while helping you develop wealth building habits that support your long term goals by converting your currency to sound money.

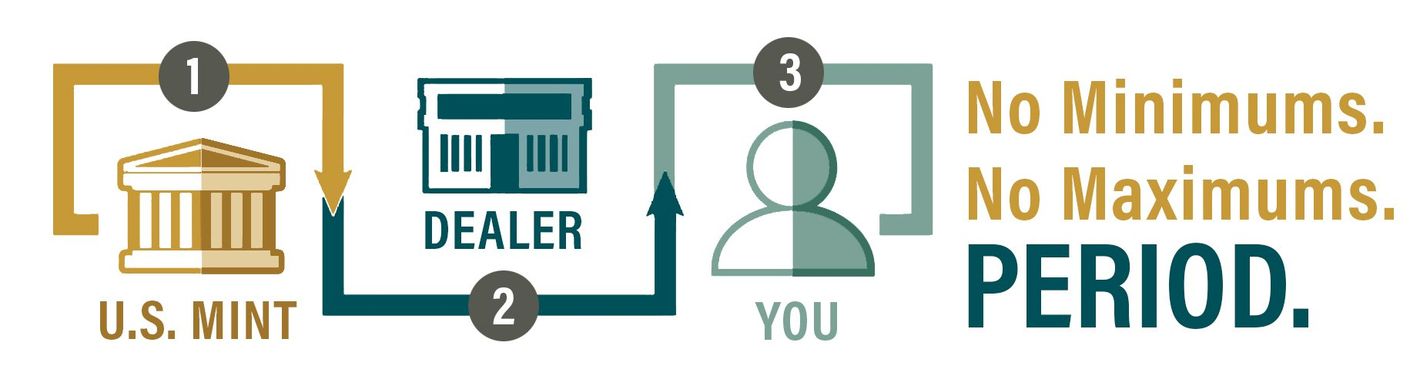

Dealer-Direct Pricing on Gold & Silver

We cut out the middle man allowing you to have easier access and better prices on gold and silver bullion without the games and gimmicks. No Minimums, No Maximums. Period.

Take control of your financial future!

Appointments Available!

If you want to learn more about how McDuffie Metal Associates can help, sign up for a FREE 1-on-1 consultation using the link below. These calls will allow us to explain the benefits of the membership program and answer any questions you have.

Most consultations last approximately 30 minutes and we respect your time. However, we’ve allotted plenty of time to each slot in order to accommodate additional support and instruction as needed.

I don’t care to schedule an appointment at this time, I simply want check out all the cool products. We'd greatly appreciate your business.

Get in Touch

- Interested in investing but not ready to schedule an appointment?

- Have questions about the process?

- Do you simply want to take a look at all the cool products we offer?

Fill out this form and we'll get back to you as soon as we can.

We will get back to you as soon as possible.

Please try again later.

All Rights Reserved | McDuffie Metal Associates | Powered by Spirelight Web